OVERVIEW

Taxes owed on PUP and EWSS to be repaid over 4 years – starting January 2022

Revenue has announced that workers affected by COVID-19 will repay the taxes owed on the Pandemic Unemployment Payment (PUP) and the Temporary Wage Subsidy Scheme (TWSS) over a four year period, beginning January 2022.The decision to collect the tax over four years from 2022 has been made to reduce hardship on those affected.

The EWSS and PUP were quickly introduced by the Government in response to the financial crisis that emerged as the coronavirus pandemic gripped the world. In December 2021, every employee in Ireland will receive a Preliminary End of Year Statement which will display the amount of EWSS or PUP payments they received. The statement will also provide a calculation of income tax and USC charged to each worker over the course of 2020, and determine whether there has been any over or under-payment.

Employment Wage Subsidy Scheme (EWSS)

The purpose of the Employment Wage Subsidy Scheme is to keep employees registered with their employers and to enable employers to continue to pay wages during the pandemic. In short, employees with a previous average net pay of up to €412 per week (roughly €24,400 per year) receive a subsidy of 85% of their previous net weekly pay.

A payment of up to €350 applies where the employee’s net weekly pay is between €412 – €500. A 70% subsidy is payable where an employee’s previous average net weekly pay is more than €500 but not more than €586, with maximum cap of €410. The TWSS was replaced earlier this month by the Employment Wages Subsidy Scheme (EWSS).

Revenue said it will issue a Preliminary End of Year Statement to all employees, including those who received the TWSS and PUP, at the beginning of next year “The Preliminary End of Year Statement will include pre-populated information showing the amount of EWSS and/or PUP payments, if any, received by the employee concerned according to Revenue records,”. “The statement will also provide employees with a preliminary calculation of their income tax and USC position for 2020 and will indicate whether their tax position is balanced, underpaid or overpaid for the year’.

The employees concerned will then be given time to amend their records if needed, declare any further income and claim additional tax credits due to them. These might includes credits for things like health expenses or flat rate expenses. Once the adjustments have been made through Revenue’s online MyAccount function, a final liability for this year will be calculated. The employees will then be able to pay what they owe Revenue in full or in part through MyAccount. “Otherwise, Revenue will collect the liability, interest free, by reducing the employees tax credits over four years to minimise any hardship”.

Budget 2021

A christmas bonus of 100% will be paid in early december 2020 to people getting PUP for at least 4 months.

An earnings threshold of €480 per month will be introduced for self-employed people getting PUP to allow them to take up occasional work opportunities and keep their PUP.

Self-employed people who resume their business on a limited or reduced basis when they leave PUP will be eligible for the Part-Time Job Incentive scheme.

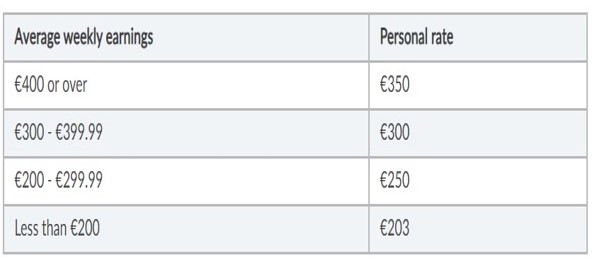

From 16 October 2020 to 31 January 2021, COVID-19 Pandemic Unemployment Payment (PUP) weekly rate:

What to do if you have a tax liability?

Workers can reduce the impact of the pandemic payments by ensuring they avail of all of their tax credits and reliefs.

By applying with Taxreturned.ie, you can carry out a full four-year review of your tax situation.

Our tax team will examine your entitlements and ensure you are claiming everything you are due.Why apply with Taxreturned.ie?

- Easy online process – no complicated forms

- You’ll avail of every credit or relief you’re entitled to

- We will maximise your tax refund or minimise your liability

24/7 Live Chat tax support.

No Comments